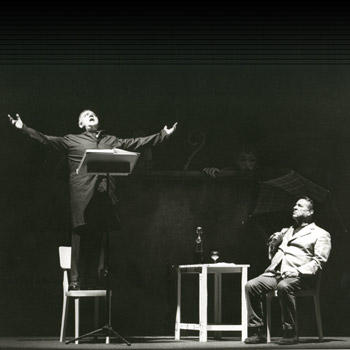

Fiorello revises an old Italian cabaret classic.

Modern Times?

Dreams

In my dreams I have a plan

Fiorello revises an old Italian cabaret classic.

Modern Times?

Dreams

In my dreams I have a plan

The Times reports that there is nothing to worry about the queues forming outside the Central Bank. The picture taken by the Times shows a snaking queue outside the Valletta office of the Central Bank. Obviously the Times’ calming headline must be read in the context of the current economic scenario. Belgium for example is on tenterhooks as the Flemish and Walloon factions iron out their 2012 budgets with clear warnings that there will be spending cuts (as if the obligation of balancing a cabinet with 7 + 7 ministers sought from the linguistic divide was not enough). Standard & Poors has already delivered a sucker punch to the little Kingdom as the King tries to piece his Humpty Dumpty government together. Belgian radio news reported that there was still enough public confidence in government bonds but even this will not remain a given. Niall Ferguson penned an interesting futuristic article in the Times (UK) news review this Sunday speculating on the political break up of the EU and the formation of a United States of Europe (with a nod or two to the Hapsburgian influence on the process). The international specialist press is focusing on one thing and one thing only… will the euro survive and if not how long till armageddon.

Meanwhile in Malta there is a rush on the central bank.

To buy commemorative coins.

Italy’s sovereign debt rating has been revised downwards (A from A+) by Standard and Poor’s. The marginal comment to this revision was that the country’s outlook was “negative”. Notwithstanding Berlusconi’s “manovra” that seemed to have appeased worries in the institutional corridors of Brussels, the credit rating agency “cited fears over Italy’s ability to cut state spending and bring its finances in order, particularly given the country’s growth prospects.” (BBC)

The Italian government’s reaction to this revision is once again redolent of the double-vision that is evident in every major capital in Europe these days. On the one hand there is the inevitable reality that is a euroland crisis that is crying for a common solution (common because of the interdependence of the euroland states) while on the other hand there is the survival instinct of the parties in government eager to avoid losing valuable election points in the national microcosm.

Malta’s Labour has been lashing at Gonzi & Co. for what they claim is the “ostrich” mentality that has overcome Pietà and Castille. The tune from Labour and other critics of government is that the Government has “conveniently ignored” Moody’s recent downgrading. For its part, barring the bravado of mavericks like Austin Gatt, the party in government seems to be content with the government by default line that has worked so well in recent years. While it is true that Labour is far from offering a practical alternative to the current men at the driving seat, it is also blatantly evident that the government by default lacks a coherent, value-driven and globally conscious plan. Surely a tough nut to crack for voters.

Back to Berlusconi and his government. The first reaction to the S&P revision was a tirade on the fourth estate. His government and its manoeuvres was not to blame – instead it was the bad feeling and lack of confidence generated by the papers. Pity that the stock exchanges in Milan and elsewhere seemed to be more on the wavelength of S&P and the papers than on Berlusconi’s side. Here is part of Palazzo Chigi’s official reaction (from La Stampa):

«Il governo ha sempre ottenuto la fiducia dal Parlamento, dimostrando così la solidità della propria maggioranza. Le valutazioni di Standard & Poor’s sembrano dettate più dai retroscena dei quotidiani che dalla realtà delle cose e appaiono viziate da considerazioni politiche»

The question is whose reality (realtà) is the real one and whose is the virtual?

The truth is out there.

Controversial historian Niall Ferguson sees no solution for the current European Debt Crisis which he describes as a “European Lehman Brothers“. Are we really in for a shocker? Is the biggest strike still to be dealt on the European economy? Will the euro suffer the consequences? Worse still, is it – as Joseph Muscat would have it – the fault of GonziPN?